ABUJA think tank Agora Policy has warned the federal government that Nigeria’s growing debt profile is unsustainable and is putting the country in a perilous situation due to the high cost of debt servicing.

In a report titled Options for Revamping Nigeria’s Economy’, the group noted that debt servicing has become one of the biggest elements of the country’s expenditure. In part, the report read: "Alarmingly, debt service was the largest component of expenditure with N1.94tn ($4.44bn), followed by non-debt recurrent expenditure (N1.7tn), capital expenditure (N773.63bn) and statutory transfers (N289.89bn).

"Thus, the country is in the precarious situation of borrowing to pay back debt. Since revenue was N1.63tn and debt service was N1.94tn, the government borrowed N308bn to pay back debt. This is clearly a perilous situation.”

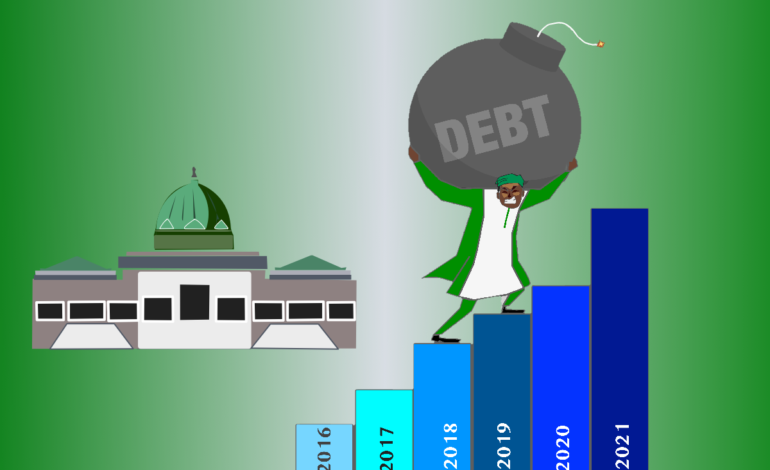

Also, the report noted that the low revenue generation of the federal government has led to high debt stock and high debt service payments. Furthermore, according to the report, the total debt stock of Nigeria increased by 436% from N6.17tn in December 2011 to N33.11tn in December 2021.

Within the same period, domestic debt increased by 242% from N5.6tn to N19.2tn, while foreign debt increased by 2,435% from N546bn to N13.86tn. Official debt stock statistics do not include the federal government's borrowing from the Central Bank of Nigeria through Ways and Means which increased by over 7,000% from N265.7bn in January 2014 to N18.89tn in March 2022.

Adora Policy report added: “Thus, if the debt from Ways and Means as of December 2021 (N17.4tn) is added to official debt, the domestic debt stock as of December 2021 rises to N36.6tn. It is clear that both the federal government's expenditure and debt have increased over time and this, coupled with the fact that debt service exceeded revenue in the first four months of 2022 would indicate that debt is unsustainable.

“This scenario would ordinarily not present such a big problem if revenue had increased over the same period. However, the federal government's revenue, rather than increase, has actually fallen, which presents the most critical fiscal problem facing the government."

Asking that something be done, the group advised the government to deepen and diversify sources of revenue, re-calibrate expenditure to spend smartly and invest efficiently. Waziri Adio, the Agora Policy executive director, said the decision to focus on the economy was driven by the need to expand policy and programmatic options for the current and next administrations.

He added: “Everything revolves around the economy and there is no better time than the electioneering period to do a health check on the economy and come up with ideas and prescriptions for better economic outcomes. We commissioned this report to elevate the discussions during this important campaign season and to facilitate the search for solutions in an area that is central to national growth and human development.”

Dr Sam Nzekwe, a former president of the National Accountants of Nigeria, agreed with him that Nigeria’s debt was unsustainable. He also said that instead of focusing on the debt to gross domestic product ratio, the focus should be on debt service to revenue ratio, noting that Nigeria has a revenue problem.

“The debt is huge and if you look at the budget, you will see that a huge sum of money is used to service debts. This is just the debt service charge, we are yet to talk about the principal, ” Dr Nzekwe added.